Summary

Nvidia has been historically blessed by its superior GPU product performance.

Nvidia has a relatively flat demand curve; units demanded is mainly driven by product performance and less by product pricing.

Nvidia has felt the increasing pressure to respond to AMD’s new GPU product roll out at a low ASP.

Nvidia’s inelastic demand curve suggests that changing prices will have less impact on market share changes.

As Nvidia stock price has been typically more responsive to revenue and EPS, not to market share, it would be an ineffective defense for Nvidia to wage a price war.

Against both Intel (INTC) and Nvidia (NVDA), Advanced Micro Devices (AMD) has used a low pricing strategy to gain market share. At least versus Intel, this strategy has served AMD well. Selling between twice and three times of AMD’s price levels, Intel has lost more than 8% CPU market share to AMD for the last three years. Given that Intel just delayed its Ice Lake server product again by three months to Q4 of 2020, it is imperative that Intel comes up with some kind of defense against AMD’s threat on the CPU market share. Not surprisingly, Intel is rumored to slash the prices of its 8th and 9th Gen Coffee Lake lineups.

On Nvidia’s side, it’s no secret that GPU prices have already begun falling, and the trend apparently will continue. Over the last few months, the price of Amazon’s top seller in graphics cards, the XFX Radeon RX 580, has fallen from a high of $260 to $189. The Gigabyte GeForce GTX 1060 Windforce is currently at half off the MSRP around $190. Since Nvidia’s CEO confirmed the lackluster RTX demand, the price drop on products like the EVGA GeForce RTX 2080 XC is not expected to reverse in the short run. Nobody seems to have a clear idea of how long the oversupply of GPU and low prices will continue, but AMD’s Dr. Lisa Su seems to believe that overhanging inventory will be over by the second quarter. Su said she expects that AMD will see improved GPU channel inventory levels, then return to sequential growth. While it’s possible that some of AMD’s older GPUs will continue to enjoy low prices, AMD is banking on demand for its Radeon VII, and eventually Navi, to boost prices once again.

After AMD announced new Radeon GPUs to threaten Nvidia's RTX offerings at their relatively lower prices, Nvidia decided to fight back with the new RTX Super cards, which offer more performance for the same price. Specifically, Nvidia plans to roll out GeForce RTX 2060 Super and RTX 2070 Super cards on July 9 and the RTX 2080 Super on July 23. The Turing-based cards will retail for $399, $499, and $699, respectively. Nvidia says the 2080 Super offers faster performance than its current top-of-the-line Titan Xp. In response, AMD has responded by lowering the price of the new Radeon RX 5700 series of GPUs before they're even officially released.

In a recent tweet, AMD announced that the Radeon RX 5700, 5700 XT, and 5700 XT 50th Anniversary Edition will all start at lower price points than originally expected. The Radeon RX 5700 will now start at $349, $30 below the original price. The RX 5700 XT will now cost $399 instead of $449, and the RX 5700 XT 50th Anniversary Edition will cost $449 instead of $499. In other words, each of AMD’s new cards now match the prices of Nvidia's RTX 2060, 2060 Super, and 2070 Super, respectively. Not surprisingly, Nvidia is tempted to lower prices to combat AMD’s assault on GPU market share.

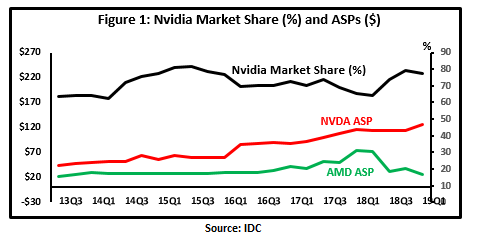

However, lowering prices does not necessarily translate into larger market share. Historically, due to superior product performance, Nvidia has never had to rely on pricing strategy to increase market share. While Nvidia has 2 to 2.5 times of average selling price (ASP) over AMD, its market share has rarely been affected by the relative ASP level. Case in point, Nvidia currently has a near high market share around 80%, while its ASP is also near high around $110, along with AMD’s near low ASP around $20 (Figure 1). Apparently, Nvidia does not own the lion share of the GPU market because of its product being priced relatively cheap. More likely, the large revenue and market share are a result of superior product quality and performance.

As ASP correlates with gross margin, Nvidia’s lowering ASP will almost always lower the gross margin. As a result, it is logical that a high ((low)) ASP will decrease (increase) market share but increase (decrease) EPS. The bottom line is that, since both a better product quality and a lower relative pricing may increase market share, there is little incentive for Nvidia to lower prices and EPS to boost market share, which can be easily achieved by the brand quality. On the other hand, the revenue implication is not as straightforward as it seems. A low pricing strategy will increase unit shipment or a larger market share, but at a lower ASP. The total revenue may or may not increase depending on how much unit shipment will increase in response to ASP decrease.

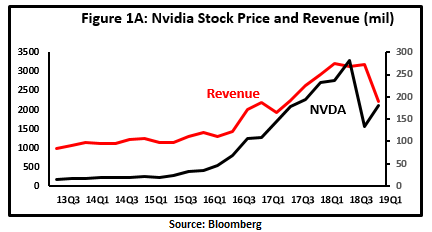

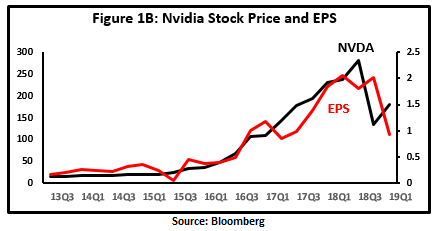

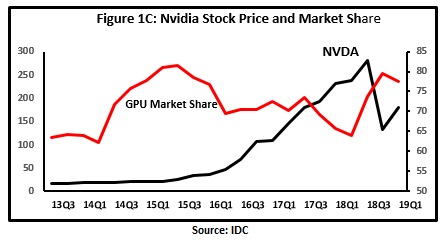

This is why the effectiveness of a low pricing strategy (against AMD) varies significantly between Intel and Nvidia. With a comparable product competing with Intel, AMD's relatively lower price becomes an important distinguishing advantage to get the market share. But the same price advantage does not play out since Nvidia traditionally has a better GPU card. Gaming users are willing to pay more for a better performing Nvidia card. In fact, Nvidia’s high prices have become a status symbol to signal superior performance. This is also why Nvidia’ stock prices have been traditionally more affected by total revenue (Figure 1A), and EPS (Figure 1B), but not by market share (Figure 1C).

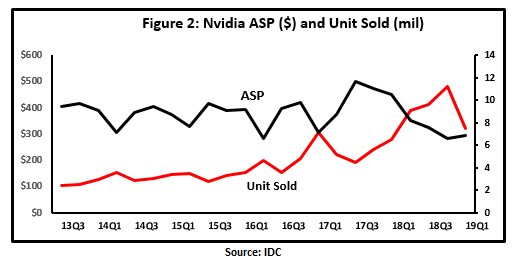

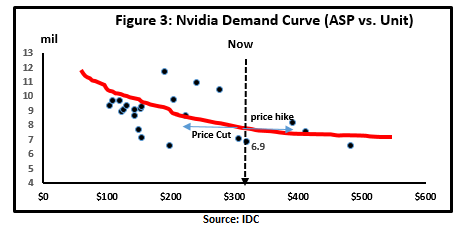

If one insists on using pricing strategy to change quantity sold, the “flat” shape of a demand curve may limit the extent of the effectiveness. In terms of how Nvidia unit shipments reacts to any price changes, I displayed Nvidia’s downward sloping demand curve in Figure 3. This is demonstrated by the actual combination between the average price sold and the number of unit (in million) shipment, where the average unit price (AP) is estimated by the revenue per unit sold. It appears that the unit demanded inversely relates to ASP over time, as a typical demand curve would suggest (Figure 2). As Nvidia’s Q1 2019 AP is around $320, there will be quantity gain if the AP is lowered, compared to the quantity loss if the AP is raised (see the current line in Figure 2). At this point, because the demand curve becomes increasingly flat, it would suggest that there will be less quantity loss ((gain)) if the price is raised (lower). The “inelasticity” of the demand curve is equivalent to say that it is “less effective” to lower prices to increase quantity demanded, compared to other times (or price points).

After receiving equally large amount of criticisms from my last two posts, “It’s Time for AMD to Raise Prices” and “Intel Should Lower Prices Soon,” I feel it is only appropriate to complete the third post, “Nvidia Should Not Change Prices”. Compared with Intel’s market share relative to AMD, Nvidia has been mainly blessed by its superior GPU product performance. This is why Nvidia has a relatively flat demand curve that unit demanded is mainly driven by product performance less than by product pricing.

However, in the recent period, all semis' unit shipments, revenue, and stock prices have fallen due to the negative macro picture. As the total “pie” stops growing, Nvidia has felt the need to respond to AMD’s new GPU product roll out at a low ASP. However, Nvidia’s inelastic demand curve would suggest that changing product prices will produce less quantity changes. Or, relative pricing changes will have less impact on market share changes. Furthermore, Nvidia stock price has been typically more responsive to revenue and EPS, not to market share. Therefore, it would be an ineffective defense for Nvidia to get into a price war with AMD by lowering product prices.

Copyright © 2021 Shenzhen Broocean Information Technologies Co.,Ltd. Copyright All Right Reserved 粤ICP备15073664号-1